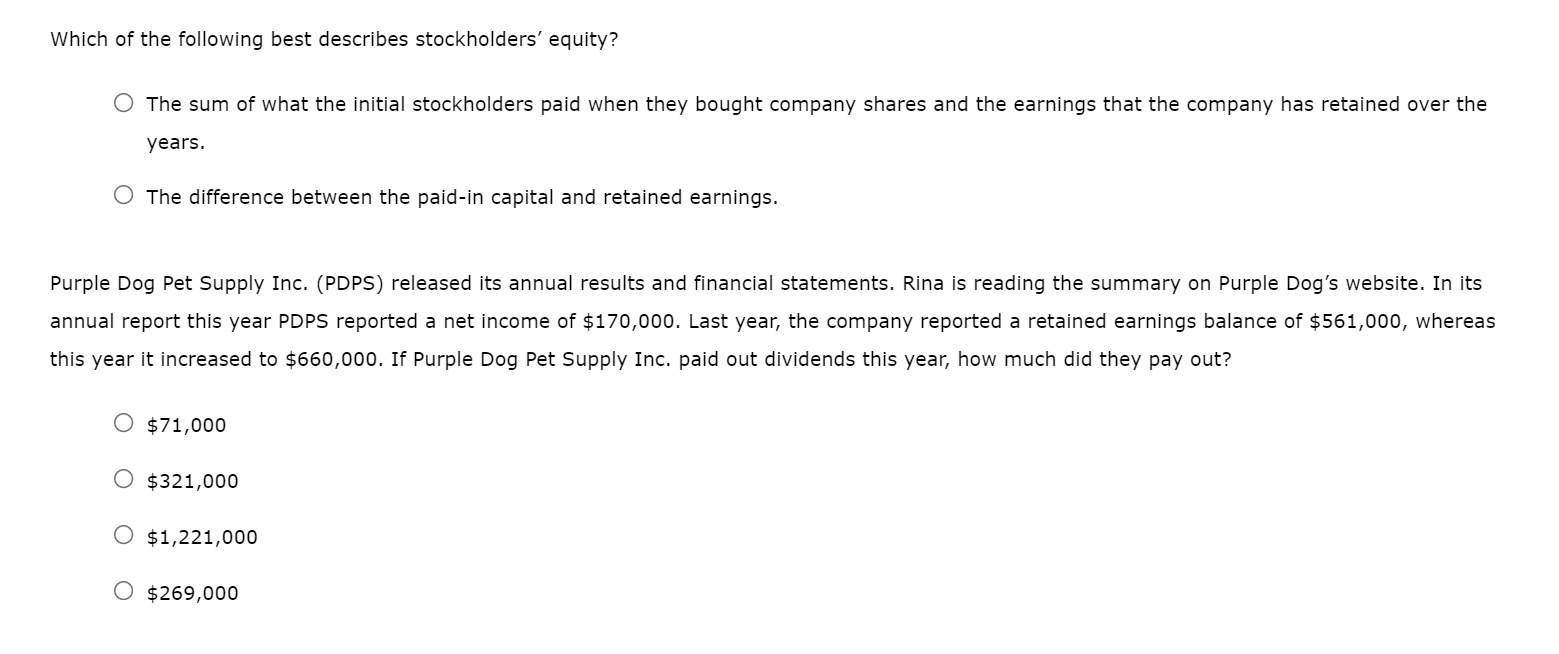

Which of the Following Best Describes Stockholders Equity

Which of the following describes the information reported in the statement of stockholders equity. Which of the following best describes shareholders equity.

Solved Stockholders Equity The Right Side Of The Balance Chegg Com

Equity is the difference between the companys assets and liabilities.

. Which of the following best describes shareholders equity. Write an equation that best models this data 26 The Winter Garden is a theatre on West. Which of the following characteristics describes a statement of changes in owners equity.

It provides information pertaining to a companys economic resources and the sources of financing for those resources. Assets Liabilities Stockholders Equity D. Equity is the sum of what the initial stockholders paid when they bought company shares and the earnings that the company has retained over the years.

The difference between total revenues and total expenses less dividends for the year. O Equity is the difference between the paid-in capital and retained earnings. 12 Which of the following best describes the balance sheet.

Assets Liabilities Stockholders Equity If liabilities decreased by 15000 and stockholders equity decreased by 5000 then the right side of the accounting equation decreased by 20000. Assets Liabilities Stockholders Equity B. Stockholders equity The right side of the balance sheet shows the firms liabilities and stockholders equity.

Which of the following best describes the balance sheet. Therefore assets must have decreased by 10000 to keep the accounting equation in balance ie 15000 5000 20000. Assets and stockholders equity increase when.

The initial claim on value of a companys assets before it pays off its liabilities. Contributed capital also known as paid-in capital is the cash and other assets that shareholders have given a company in exchange for stock. The difference between a companys assets and liabilities.

O Equity is the sum of what the initial stockholders paid when they bought company shares and the. Released its annual results and financial statements. Which of the following best describes shareholders equity.

Which of the following best describes shareholders equity. They are the economic resources used by a business entity. The right side of the balance sheet shows the firms liabilities and stockholders equity.

A It includes a listing of assets at their market values. Assets Stockholders Equity Liabilities C. Equity is the difference between the companys assets and liabilities.

This is not an asset but an equity. Stockholders equity will increase. Equity is the initial claim on value of the assets before the firm pays off its liabilities.

Change in stockholders equity through changes in common stock and retained earnings. The initial claim on value of a companys assets before it pays off its liabilities. Thus option B is the correct answer.

Stockholders equity will decrease. The right side of the balance sheet shows the firms liabilities and stockholders equity. Net income for the period calculated as revenues minus expenses.

Assets Liabilities Stockholders Equity. The difference between a. The amount of common stock less dividends over the life of the company.

The statement about shareholders equity given in option A that it is the difference between the paid-in capital and retained earnings is incorrect as the retained earnings are a part of the equity of shareholders and are included in the calculation of shareholders equity. Which of the following best describes liabilities and stockholders equity. Which of the following best describes stockholders equity.

It includes a listing of assets at their market values. At least one of these must increase whenever assets increase. A Equity is the difference between the companys assets and liabilities B Equity is the initial claim on value of the assets before the firm pays off its liabilities.

They are the sources of financing an entitys assets. Which of the following best explains the meaning of total stockholders equity. Equity is the difference between the companys assets and retained earnings.

Assets Liabilities Contributed Capital. Which of the following statements best describes the effects of recognizing revenue earned by a business entity. Purple Dog Pet Supply Inc.

Equity is the sum of shareholders capital provided by shareholders and retained earnings. PDPS released its annual results and financial statements. All revenues expenses and dividends over the life of the company.

It includes a listing of assets liabilities and stockholders equity at their market values. C It provides information pertaining to a company s liabilities for a period of time. Equity is the difference between the companys assets and retained earnings.

Assets increase only when cash sales are made. And stockholders equity at a specific date Statement of financial position presents the revenues and expenses for a specific period of time Income Statement. Which of the following best describes stockholders equity.

Equity is the sum of shareholders capital provided by shareholders and retained earnings. Equity is the initial claim on value of the assets before the firm pays off its liabilities. Stockholders equity increases only when credit sales are made.

Balance sheet or statements of financial positions is a statement is used to show the financial positions of the entity. They are reported on the income statement. Total assets equal total liabilities plus stockholders equity.

B It includes a listing of assets liabilities and stockholders equity at their market values. Which of the following best describes shareholders equity.

Solved Which Of The Following Best Describes Stockholders Chegg Com

Solved 5 Stockholders Equity The Right Side Of The Balance Chegg Com

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

0 Response to "Which of the Following Best Describes Stockholders Equity"

Post a Comment